Research: Scooping Success - Evolution of Ice Cream Industry!

By Meghan Singh, Consultant, Thellion Ventures

The ice cream business in India has witnessed remarkable evolution over the decades, transitioning from being a niche luxury item to a widely consumed product. In the early years, ice cream was primarily homemade or sold by small vendors and local dairies. The market began to take shape in the 1980s and 1990s with the entry of organized players, who brought technological advancements and standardized production. The introduction of refrigeration technologies and an increase in disposable incomes further propelled the sector. Today, ice cream in India caters to a diverse audience, offering a variety of flavors, formats, and price points to suit every palate and pocket, and even taking advantage of their wide traditional background of Asian sweets.

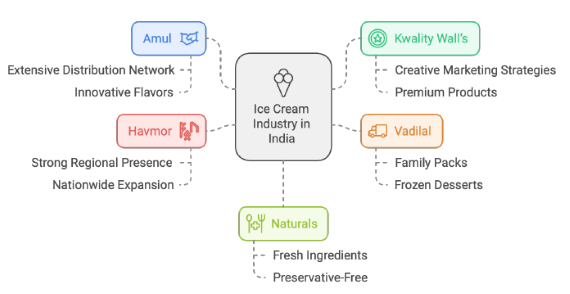

The current landscape of the ice cream industry in India is dynamic and competitive, with major players such as Amul, Kwality Wall’s, Vadilal, Havmor, and Naturals leading the market. Amul, often referred to as the largest player, dominates the market with an extensive distribution network and an array of innovative flavors. Kwality Wall’s, a Hindustan Unilever brand, follows closely, focusing on premium offerings and creative marketing strategies. Vadilal, one of the oldest players, is known for its wide variety of products, including family packs and frozen desserts. Havmor, acquired by Lotte Confectionery, has a strong regional presence and is gradually expanding nationwide. Naturals, with its focus on fresh, preservative-free ingredients, caters to the health-conscious and premium segments. Together, these companies shape consumer preferences and foster innovation in the industry.

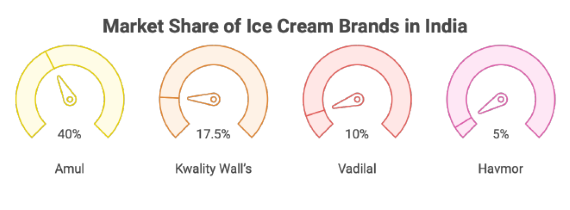

Market share distribution among these players reflects their strategies and customer base. Amul commands approximately 40% of the organized ice cream market, leveraging its affordability and pan-India presence. Kwality Wall’s holds around 15-20%, with strong urban and premium positioning. Vadilal captures about 10%, particularly in western and northern India, while Havmor and Naturals account for smaller but steadily growing shares, driven by regional loyalty and niche appeal. The unorganized sector, comprising local vendors and small manufacturers, still accounts for a significant portion, especially in rural areas. However, organized players are rapidly gaining ground, fueled by increasing consumer preference for branded and hygienically packaged products. Overall, India's ice cream market is expanding at an annual growth rate of 12-15%.

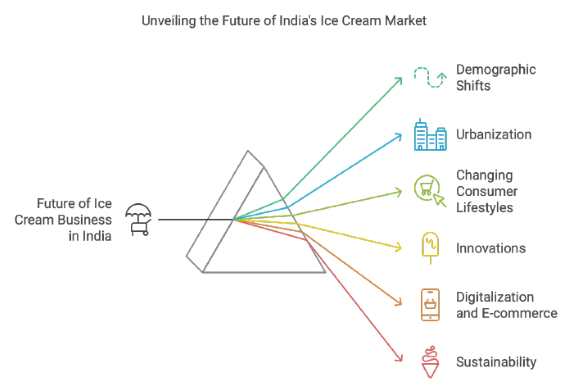

The future of the ice cream business in India looks promising, driven by demographic shifts, urbanization, and changing consumer lifestyles. Growth is expected to stem from tier-2 and tier-3 cities, where rising incomes and better cold-chain infrastructure are enabling greater access. Innovations such as vegan and sugar-free options, as well as artisanal and gourmet varieties, are also set to reshape the market. Furthermore, digitalization and e-commerce are emerging as key channels for distribution, allowing brands to reach consumers directly. As competition intensifies, companies will need to focus on sustainability, unique product offerings, and effective marketing to capture the evolving tastes of the Indian consumer. With these trends, the ice cream market in India is positioned for significant growth and profitability, driven by innovation and expanding consumer demand.

Authored by

Meghan Singh

Consultant, Thellion Ventures, Bengaluru, India

December 2024

Other Blogs

05 January, 2025

Challenges of Becoming, Being, and Staying and Entrepreneur!

BY Naren Narayana, Managing Partner, Thellion Ventures

24 December, 2024

Scooping Success - Evolution of Ice Cream Industry!

BY Meghan Singh, Consultant, Thellion Ventures